Form 1099-NEC, also known as the Nonemployee Compensation form, is an important document that independent contractors and freelancers need to be familiar with. It serves as a documentation of the income they receive throughout the year. In this post, we will explore the key aspects of Form 1099-NEC and its significance in the world of taxes.

Understanding Form 1099-NEC

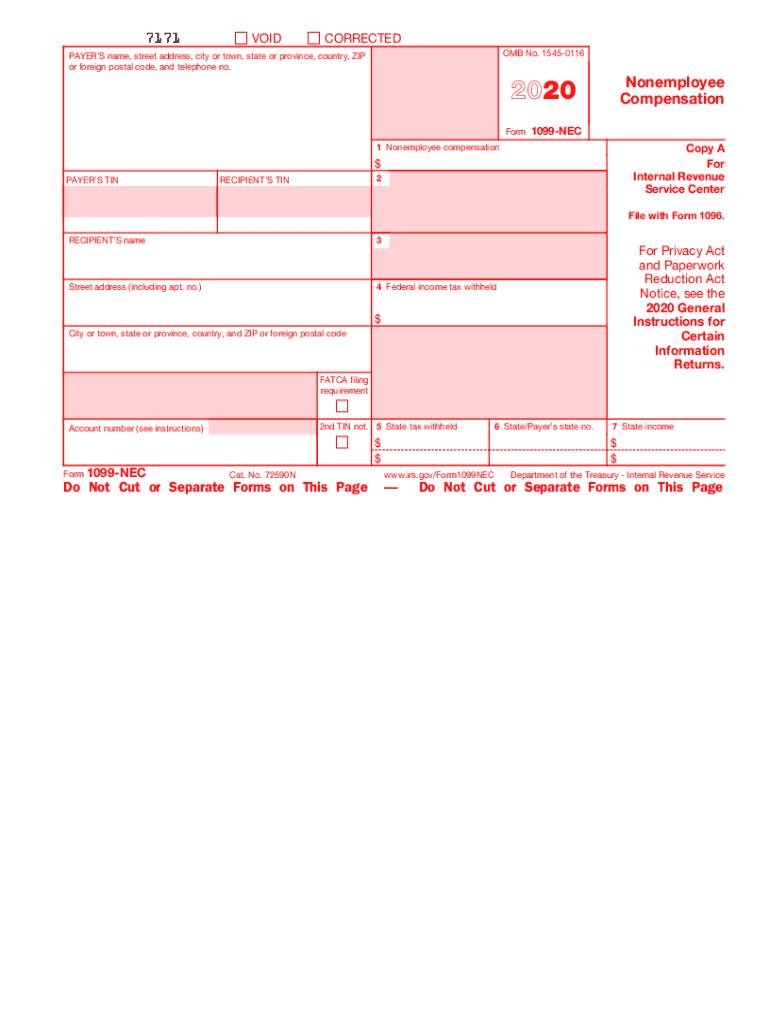

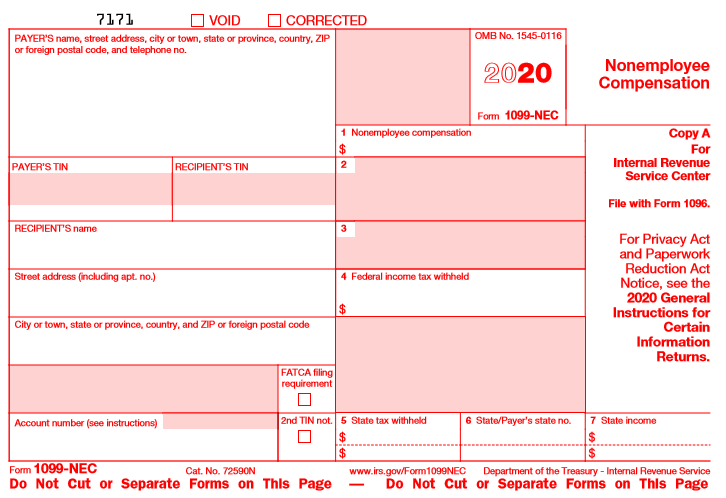

Form 1099-NEC is used to report income received by independent contractors, freelancers, and self-employed individuals who provide services to clients. The form is issued by businesses and organizations that have paid $600 or more to an individual or sole proprietor for their services during the tax year.

One of the key attributes of Form 1099-NEC is that it is specifically tailored for reporting nonemployee compensation. Previously, businesses used Form 1099-MISC to report this income, but starting from the year 2020, the Internal Revenue Service (IRS) reinstated Form 1099-NEC for this purpose.

It is crucial to understand that the income reported on Form 1099-NEC is subject to self-employment tax. Therefore, individuals who receive this form should be prepared to pay their share of Social Security and Medicare taxes.

Completing Form 1099-NEC

When it comes to filling out Form 1099-NEC, businesses must provide accurate and detailed information about the recipient and the compensation they received. The form includes sections for the recipient’s name, address, and taxpayer identification number (TIN).

In addition to the recipient’s information, businesses need to include their own identifying details, such as the employer identification number (EIN). They must also report the total amount of nonemployee compensation paid during the tax year in Box 1 of the form.

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)

It is essential to ensure the accuracy of the information provided on Form 1099-NEC, as any mistakes or discrepancies may lead to penalties or fines imposed by the IRS. Therefore, businesses should carefully review the form before submitting it to the recipients and the IRS.

Why is Form 1099-NEC Important?

Form 1099-NEC plays a crucial role in the tax ecosystem because it helps the IRS ensure that individuals are accurately reporting their income and paying the appropriate amount of taxes. By receiving this form, independent contractors can streamline their tax filing process and properly report their earnings.

Moreover, Form 1099-NEC serves as a proof of income for independent contractors when they apply for loans or mortgages. Lenders often require this documentation to verify the borrower’s income and determine their creditworthiness.

To ensure compliance with tax regulations, businesses have an obligation to issue Form 1099-NEC to eligible recipients by the end of January each year. Failure to do so can result in penalties imposed by the IRS.

Conclusion

In conclusion, Form 1099-NEC is a critical document that independent contractors and freelancers must be familiar with. It serves as a means to report and document nonemployee compensation, allowing both individuals and the IRS to accurately determine and report taxable income. By understanding the importance and completing this form accurately and in a timely manner, self-employed individuals can ensure compliance with tax regulations and avoid potential penalties.