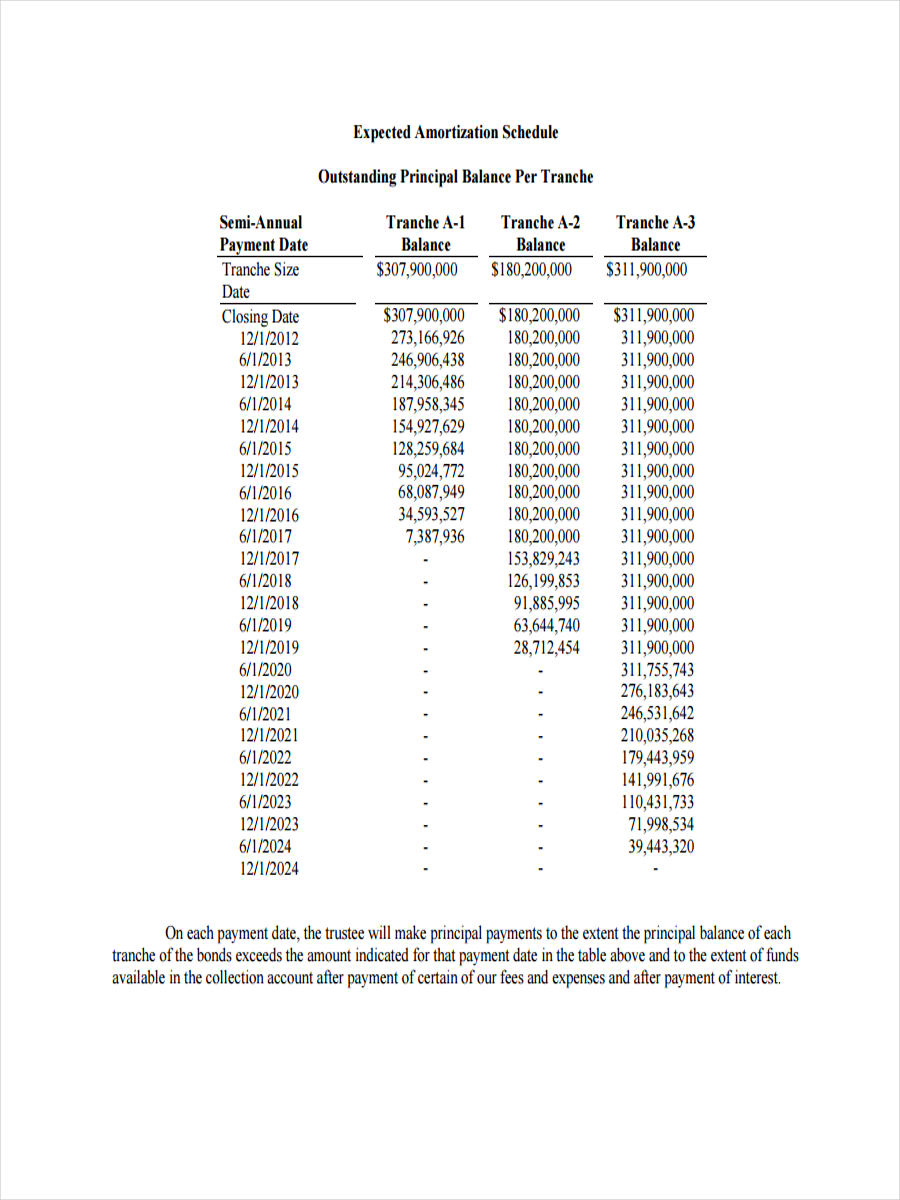

When it comes to managing finances, one crucial element that every borrower should be aware of is an amortization schedule. An amortization schedule provides a detailed breakdown of loan payments, including principal and interest, over a specific period. This schedule helps borrowers stay organized and plan their finances effectively.

Printable Amortization Schedule Templates

One of the easiest ways to access an amortization schedule is through printable templates. These templates can be found in various formats, such as Excel, PDF, and Word, making it convenient for borrowers to choose the one that suits their needs.

One of the easiest ways to access an amortization schedule is through printable templates. These templates can be found in various formats, such as Excel, PDF, and Word, making it convenient for borrowers to choose the one that suits their needs.

By utilizing printable templates, borrowers can save time and effort in creating an amortization schedule from scratch. These templates are usually pre-designed and user-friendly, allowing borrowers to input their loan details and generate an accurate schedule instantly.

Importance of an Amortization Schedule

An amortization schedule is a valuable tool for borrowers as it provides them with essential information regarding their loan repayment. With an amortization schedule, borrowers can:

An amortization schedule is a valuable tool for borrowers as it provides them with essential information regarding their loan repayment. With an amortization schedule, borrowers can:

- Stay organized: By having a clear breakdown of their loan repayment plan, borrowers can stay on track with their payments and avoid any confusion or missed payments.

- Understand payment allocation: Amortization schedules not only detail the total amount due but also specify the distribution between principal and interest. This helps borrowers understand how their monthly payments are allocated.

- Plan budget: With an amortization schedule in hand, borrowers can plan their monthly budget effectively. They can assess how much they need to allocate towards loan repayment and adjust their expenses accordingly.

Creating an Amortization Schedule

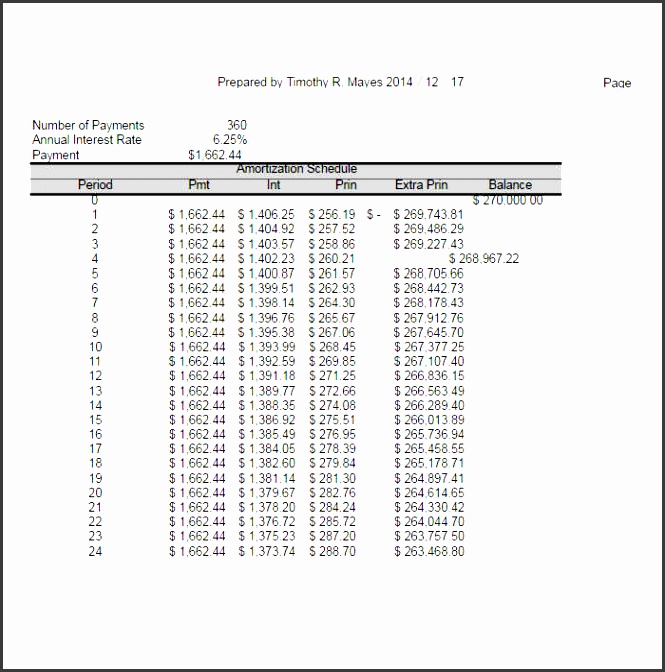

One simple way to create an amortization schedule is by using an amortization schedule calculator. This online tool allows borrowers to input their loan details, such as loan amount, interest rate, and term, and it automatically generates an amortization schedule.

One simple way to create an amortization schedule is by using an amortization schedule calculator. This online tool allows borrowers to input their loan details, such as loan amount, interest rate, and term, and it automatically generates an amortization schedule.

The calculator takes into account the interest rate and loan term to calculate monthly payments. It also provides a complete breakdown of how each payment is applied towards principal and interest, allowing borrowers to track their progress over time.

Benefits of Printable Amortization Schedule Templates

Using printable amortization schedule templates offers several advantages for borrowers:

Using printable amortization schedule templates offers several advantages for borrowers:

- Convenience: Printable templates can be easily accessed and downloaded from various online sources. Borrowers can choose the format that best suits their preferences and needs.

- Time-saving: With pre-designed templates, borrowers can save time by simply inputting their loan details and generating an amortization schedule instantly. This eliminates the need to create complex spreadsheets or calculations.

- Accuracy: Printable templates are designed to provide accurate and reliable amortization schedules. The formulas and calculations are already embedded in the templates, ensuring precise results.

It is important for borrowers to understand the terms and conditions of their loans fully. An amortization schedule is an invaluable tool that assists in this understanding. By utilizing printable templates or online calculators, borrowers can effectively manage their loan repayment and stay in control of their financial obligations.