Are you feeling overwhelmed with the approaching tax filing deadline? If so, you’re not alone. Many individuals and businesses find themselves needing extra time to complete their tax returns accurately. In situations like these, Form 4868 from the Internal Revenue Service (IRS) can provide the solution you need.

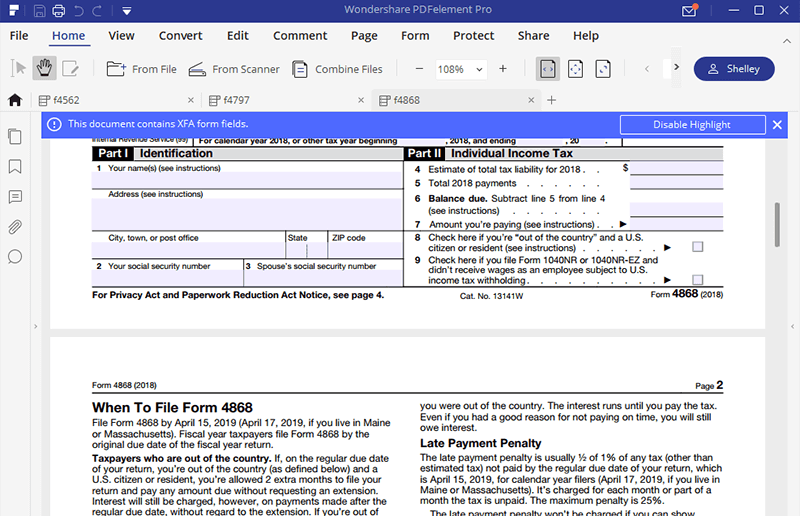

24 Printable IRS Form 4868 Templates - Fillable Samples in PDF, Word to

24 Printable IRS Form 4868 Templates - Fillable Samples in PDF, Word to

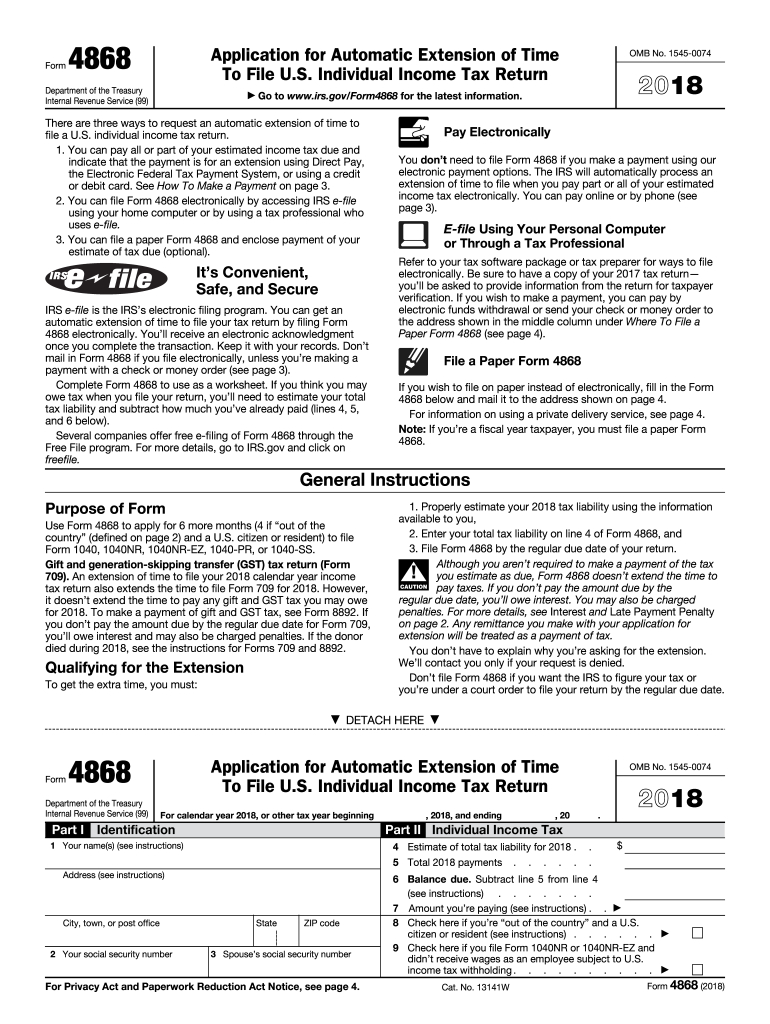

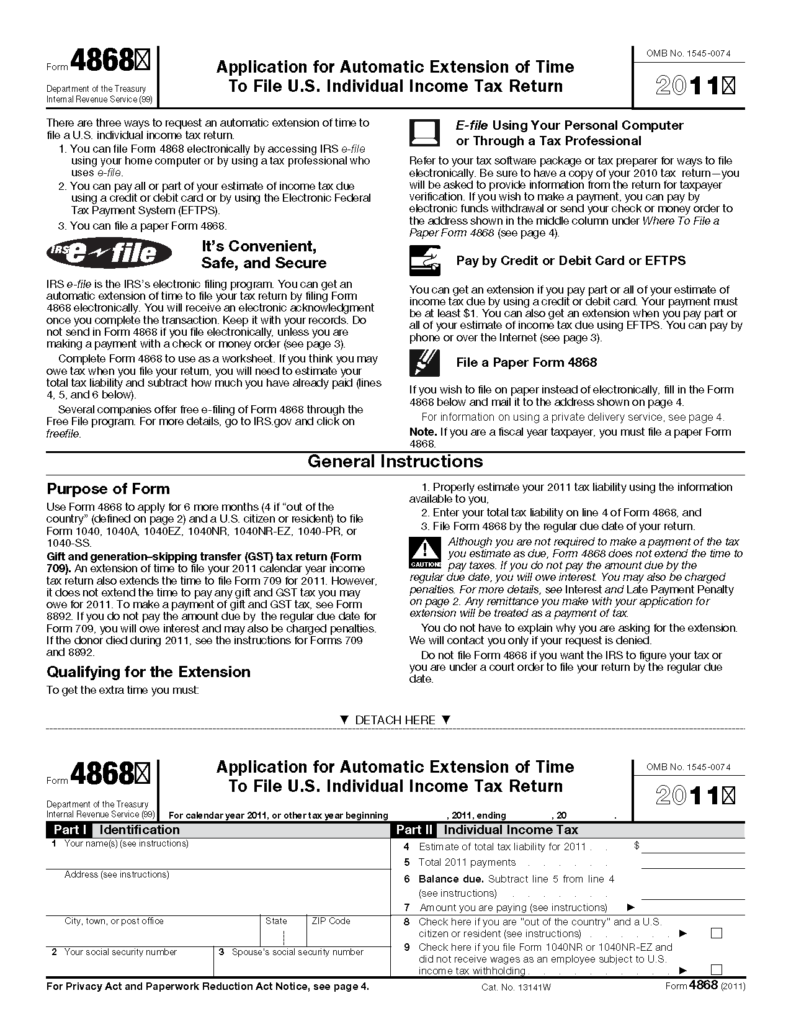

With Form 4868, officially known as the “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,” you can request an extension of the filing due date. By completing this form, you will have an additional six months to submit your tax return.

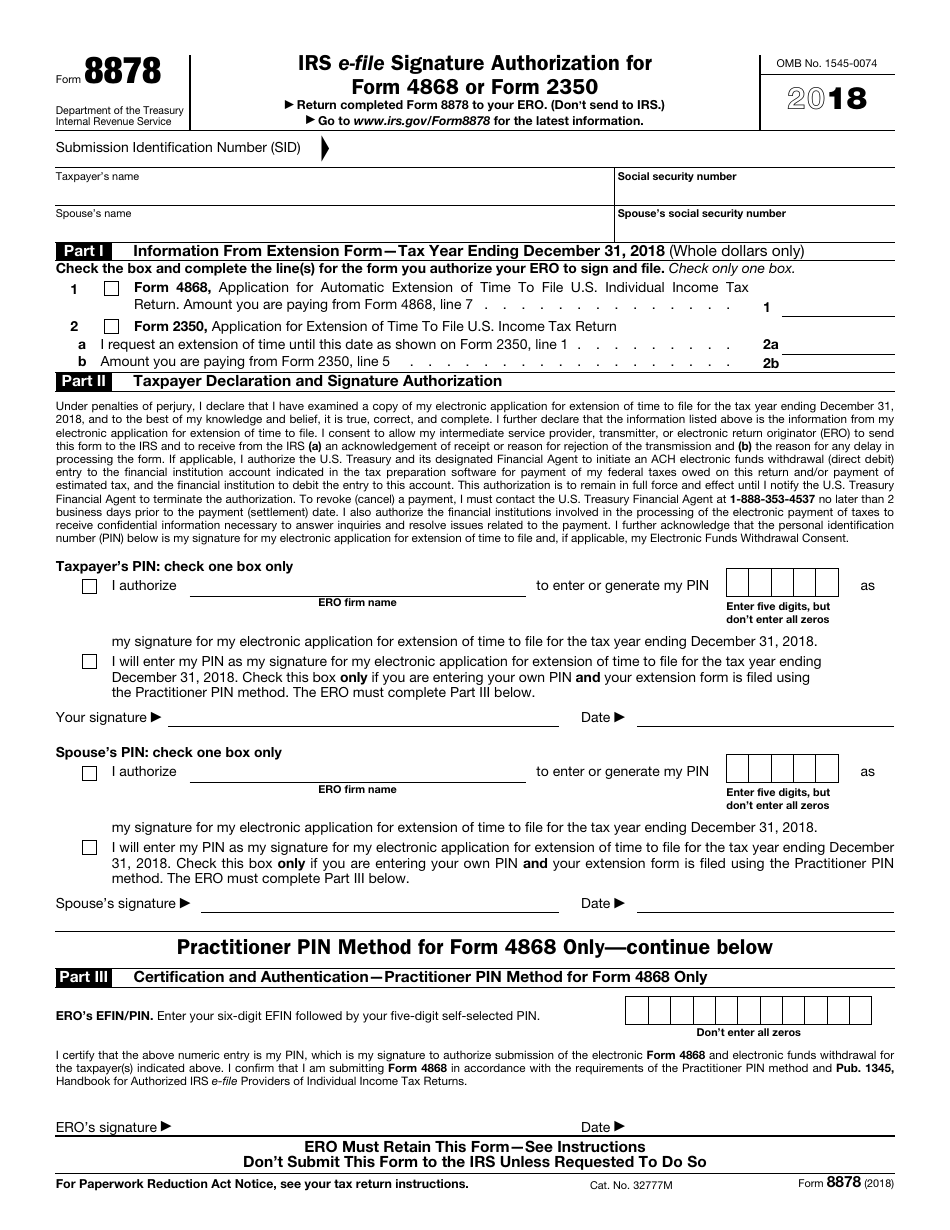

IRS Form 8878 Download Fillable PDF or Fill Online IRS E-File Signature

IRS Form 8878 Download Fillable PDF or Fill Online IRS E-File Signature

One important thing to note is that Form 4868 only extends the deadline for filing your tax return, not for paying any taxes you owe. Any tax liability must still be paid by the original deadline to avoid penalties and interest. If you anticipate owing taxes, it’s best to estimate the amount and pay it when submitting Form 4868.

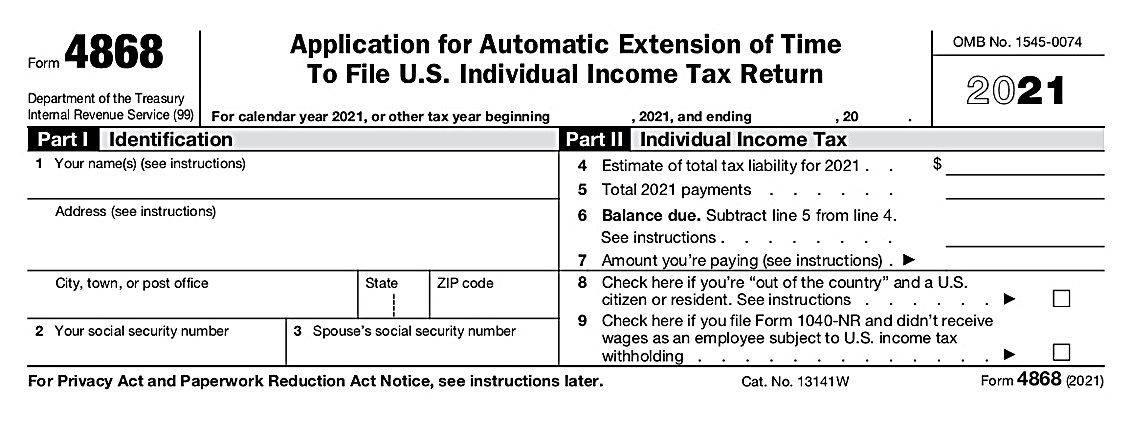

IRS Extension Form For 2023 - Printable Forms Free Online

IRS Extension Form For 2023 - Printable Forms Free Online

Completing Form 4868 is relatively straightforward. You will need to provide basic information such as your name, address, and Social Security number. Additionally, you will need to estimate your total tax liability for the year. This information will help the IRS process your extension request accurately.

Online 2016 IRS 4868 Form - Download Printable PDF Sample | IRS

Online 2016 IRS 4868 Form - Download Printable PDF Sample | IRS

Once you have completed Form 4868, you can submit it to the IRS either electronically or by mail. The IRS provides instructions on their website for both methods. It’s essential to keep a copy of the completed form and any confirmation or proof of mailing for your records.

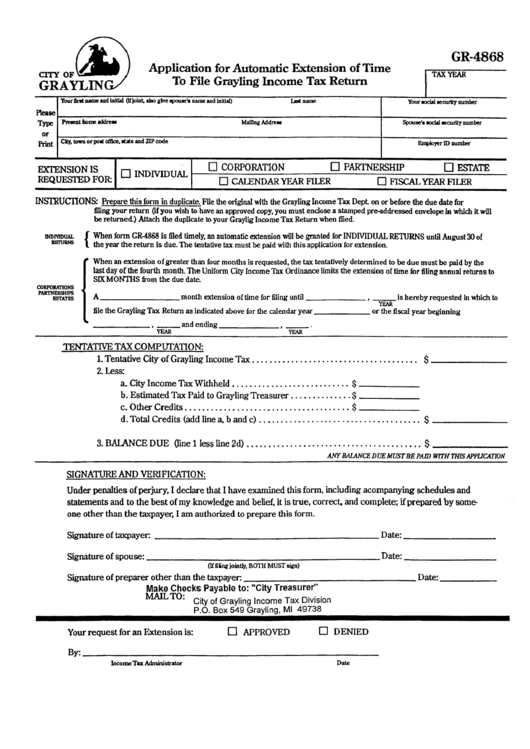

Form Gr-4868 - Application For Automatic Extension Of Time To File

Form Gr-4868 - Application For Automatic Extension Of Time To File

By filing Form 4868, you can alleviate the stress associated with meeting the tax filing deadline. This extension provides you with additional time to gather the necessary documents, consult with a tax professional if needed, and ensure your return is accurate and complete.

IRS Form 4868- Fill it Right to File Tax Form

IRS Form 4868- Fill it Right to File Tax Form

Remember, even with an extension, it’s crucial to prioritize filing your tax return as soon as possible. Failure to file by the extended due date can result in penalties and interest. If you underestimate your tax liability and fail to pay the full amount owed by the original deadline, you may also incur penalties for late payment.

Print IRS Extension Form 4868 2021 | Calendar Printables Free Blank

Print IRS Extension Form 4868 2021 | Calendar Printables Free Blank

Utilizing Form 4868 wisely can provide you with the breathing room you need to ensure you prepare an accurate tax return. Remember to pay any estimated taxes owed along with your extension request, and make sure to file your tax return promptly to avoid any unnecessary complications.

Online 2016 IRS 4868 Form - Download Printable PDF Sample | IRS

Online 2016 IRS 4868 Form - Download Printable PDF Sample | IRS

If you find yourself needing additional assistance or have questions about Form 4868 or your tax situation in general, consider consulting with a tax professional. They can provide personalized guidance and ensure you’re taking advantage of all available opportunities to minimize your tax liability.

24 Printable IRS Form 4868 Templates - Fillable Samples in PDF, Word to

24 Printable IRS Form 4868 Templates - Fillable Samples in PDF, Word to

Remember, the IRS understands that sometimes situations arise that make it difficult to meet deadlines. By utilizing Form 4868, you can avoid unnecessary stress and penalties while maintaining compliance with your tax obligations. Take advantage of the extension period to ensure accuracy and peace of mind.

Form 4868 Application For Automatic Extension Of Time To | 1040 Form

Form 4868 Application For Automatic Extension Of Time To | 1040 Form

Remember, when it comes to tax matters, it’s always best to consult with a professional. They can help you navigate the complexities of the tax code, provide personalized advice, and ensure you meet your obligations efficiently and accurately.

So, don’t let the pressure of tax season get to you. Take advantage of Form 4868 and grant yourself the extra time you need to file an accurate and complete tax return. Use the resources provided here to access printable versions of the form and additional guidance to make the process as smooth as possible.