It’s that time of year again where we need to start thinking about our taxes. Whether you’re an individual or a business owner, understanding and completing your tax forms is a crucial part of the process. Fortunately, there are plenty of resources available to help make this task a little less daunting. In this post, we’ll explore some of the best 2019 printable tax forms, along with other useful tools and tips to assist you with your taxes.

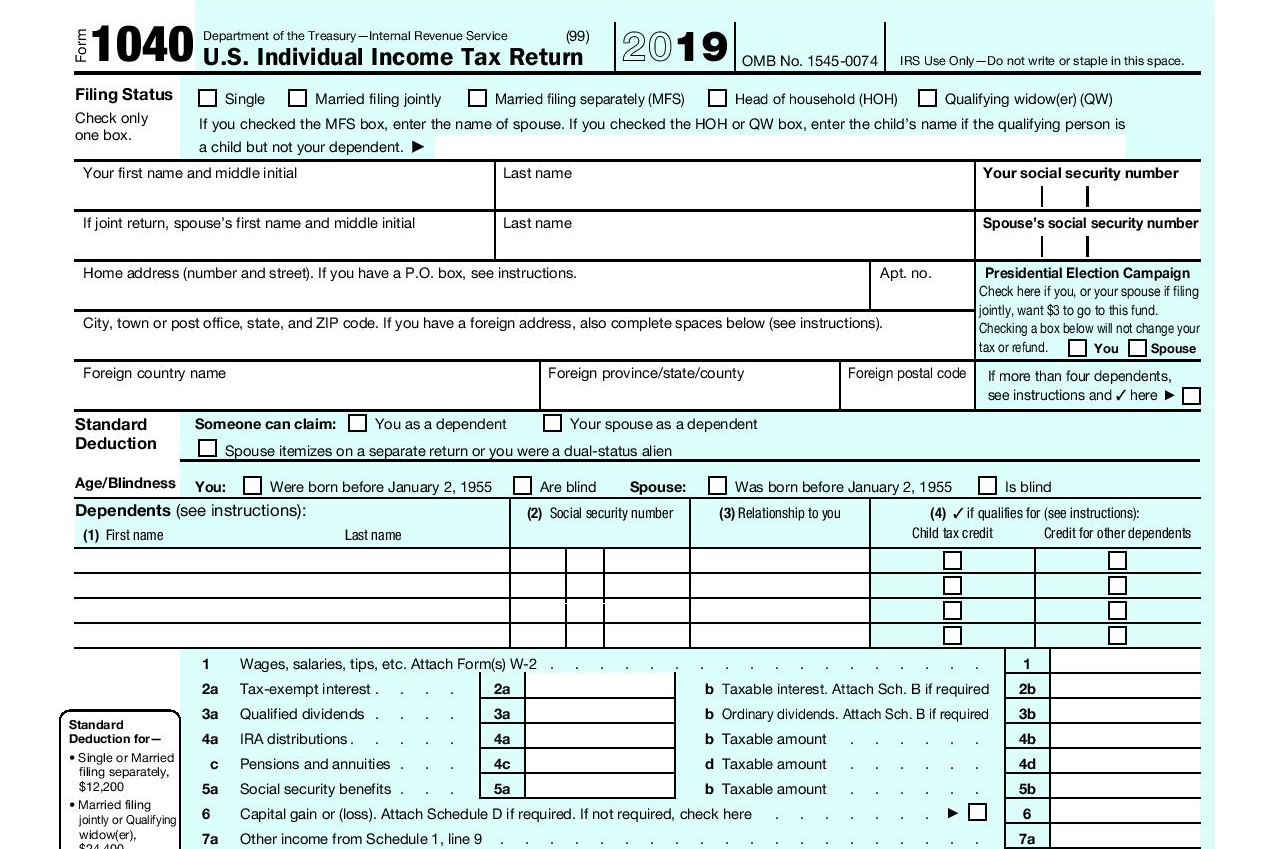

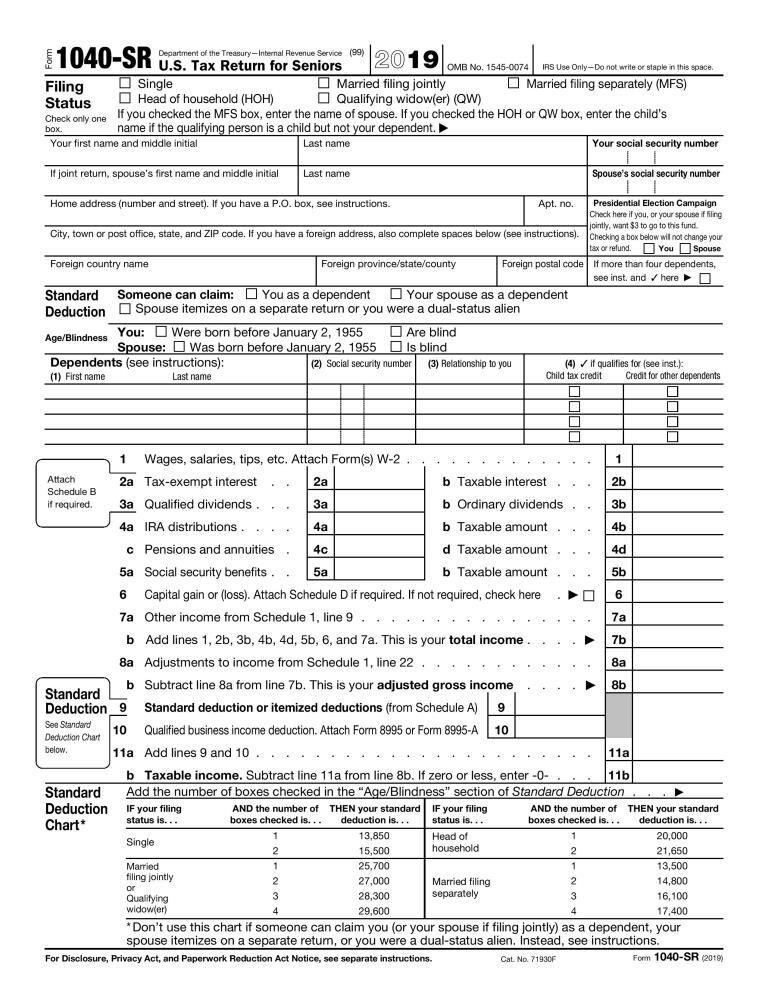

2019 Printable Tax Forms

One of the most important resources for filing your taxes is having access to the right forms. The website Income Tax Pro offers a collection of FREE 2019 printable tax forms. From the 1040 form for individuals to various business tax forms, you can find everything you need to accurately report your income and deductions.

One of the most important resources for filing your taxes is having access to the right forms. The website Income Tax Pro offers a collection of FREE 2019 printable tax forms. From the 1040 form for individuals to various business tax forms, you can find everything you need to accurately report your income and deductions.

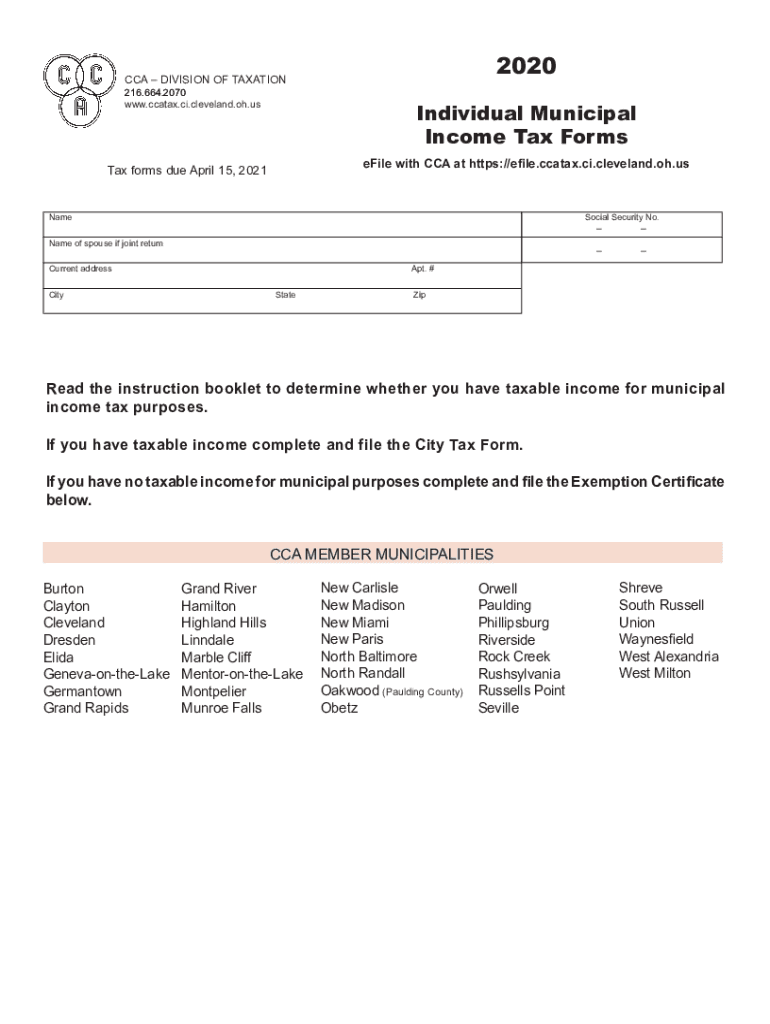

Cca Form Tax

Another useful tool for taxes is the Cca Form Tax. This printable PDF template provided by signNow allows you to fill out and sign the form electronically, saving you time and effort. With its user-friendly interface, you can navigate through the form with ease and ensure that all required information is properly inputted.

Another useful tool for taxes is the Cca Form Tax. This printable PDF template provided by signNow allows you to fill out and sign the form electronically, saving you time and effort. With its user-friendly interface, you can navigate through the form with ease and ensure that all required information is properly inputted.

Check Your Refund Status

Once you’ve filed your taxes, waiting for your refund can be an anxious time. Luckily, the IRS provides a convenient way to check the status of your refund. Simply visit IRS.gov or download the IRS2Go app. By entering the necessary information, such as your Social Security number and refund amount, you can quickly find out when to expect your money.

Once you’ve filed your taxes, waiting for your refund can be an anxious time. Luckily, the IRS provides a convenient way to check the status of your refund. Simply visit IRS.gov or download the IRS2Go app. By entering the necessary information, such as your Social Security number and refund amount, you can quickly find out when to expect your money.

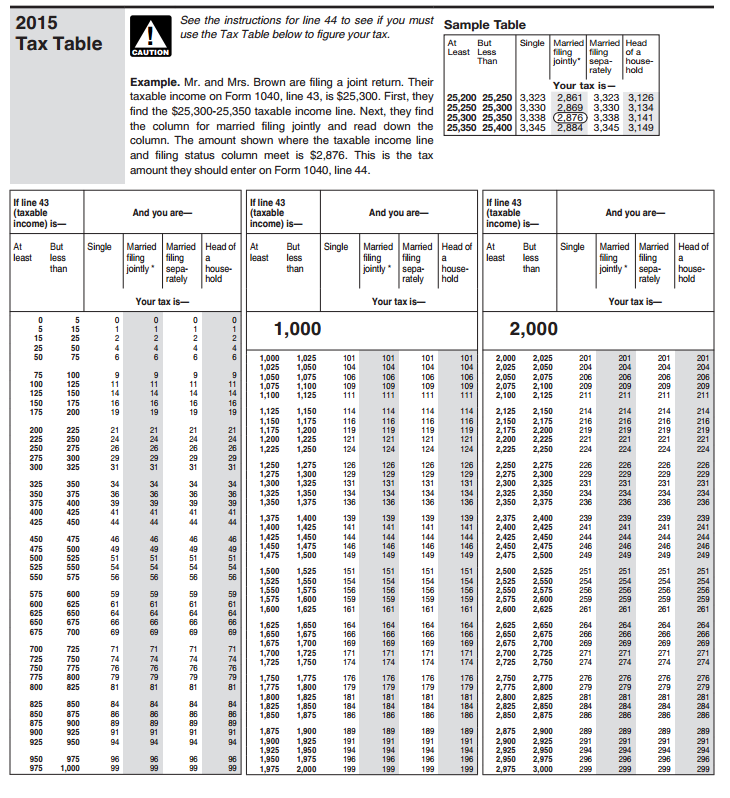

Federal Tax Withholding Table

Understanding your federal tax withholding is essential for properly calculating your taxes. The Federal Withholding Tables provides a comprehensive guide to help you determine the correct amount to withhold from your paycheck. This printable tax table for 2019 is easy to follow and ensures that you’re not overpaying or underpaying your taxes.

Understanding your federal tax withholding is essential for properly calculating your taxes. The Federal Withholding Tables provides a comprehensive guide to help you determine the correct amount to withhold from your paycheck. This printable tax table for 2019 is easy to follow and ensures that you’re not overpaying or underpaying your taxes.

The Changing Landscape of Tax Forms

It’s worth noting that the federal government has made several changes to tax forms in recent years. As reported by PCMag, these changes are aimed at simplifying the filing process. However, it’s important to stay updated on any modifications to avoid confusion and ensure compliance with current regulations.

It’s worth noting that the federal government has made several changes to tax forms in recent years. As reported by PCMag, these changes are aimed at simplifying the filing process. However, it’s important to stay updated on any modifications to avoid confusion and ensure compliance with current regulations.

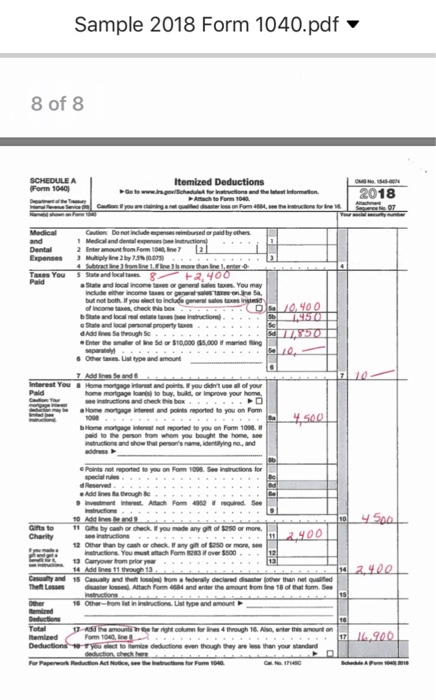

Choosing the Right Tax Form

With different tax forms available, it can be challenging to know which one is appropriate for your situation. In general, most individuals will use Form 1040 for their federal income tax return. However, factors such as your filing status, income sources, and deductions may require you to select a different form. The website 2021 Tax provides comprehensive guidance to help you determine which tax form you should use for the 2018 tax year.

With different tax forms available, it can be challenging to know which one is appropriate for your situation. In general, most individuals will use Form 1040 for their federal income tax return. However, factors such as your filing status, income sources, and deductions may require you to select a different form. The website 2021 Tax provides comprehensive guidance to help you determine which tax form you should use for the 2018 tax year.

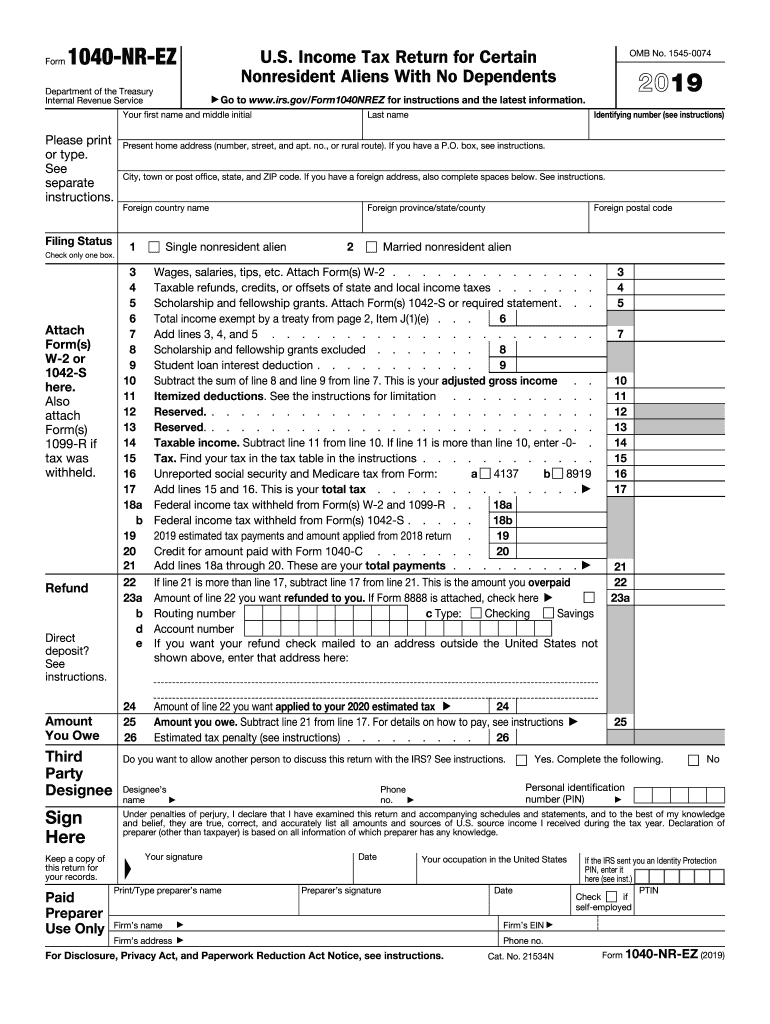

Form IRS 1040NR-EZ

If you’re a nonresident alien who earned income in the United States, you may need to file Form IRS 1040NR-EZ. This form is specifically designed for nonresident aliens with no dependents who want to claim only the standard deduction. The form can be filled out, printed, signed, and mailed to the appropriate IRS address.

If you’re a nonresident alien who earned income in the United States, you may need to file Form IRS 1040NR-EZ. This form is specifically designed for nonresident aliens with no dependents who want to claim only the standard deduction. The form can be filled out, printed, signed, and mailed to the appropriate IRS address.

Free Fillable Tax Form 1040

If you prefer to complete your tax forms online, Free Fillable Forms is an excellent resource. Their website offers a user-friendly platform that allows you to fill in your tax information directly on the screen and even perform basic calculations automatically. The service is free to use and provides a convenient alternative to paper forms.

If you prefer to complete your tax forms online, Free Fillable Forms is an excellent resource. Their website offers a user-friendly platform that allows you to fill in your tax information directly on the screen and even perform basic calculations automatically. The service is free to use and provides a convenient alternative to paper forms.

Filling out a 2017 Tax Form

If you need to fill out a 2017 tax form for any reason, Chegg.com provides a helpful tool. By using their tax form, you can accurately input your information and print a completed 2017 tax form.

If you need to fill out a 2017 tax form for any reason, Chegg.com provides a helpful tool. By using their tax form, you can accurately input your information and print a completed 2017 tax form.

Downloadable Tax Forms for 2020

For those who prefer offline access to tax forms, Child for All Seasons offers downloadable tax forms for 2020. You can simply save the PDF file to your computer or device, print it out, and fill it in manually.

For those who prefer offline access to tax forms, Child for All Seasons offers downloadable tax forms for 2020. You can simply save the PDF file to your computer or device, print it out, and fill it in manually.

Knowing where to find the right tax forms and resources can make the tax-filing process much smoother. Whether you choose to use printable forms, online platforms, or downloadable options, these resources are designed to assist you in accurately reporting your income, claiming deductions, and ensuring compliance with tax regulations. So, take advantage of these tools and make filing your taxes a breeze!